shoploto.site

Prices

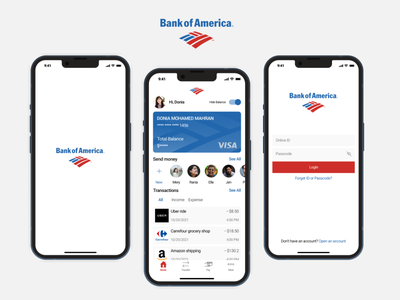

List Of Mobile Banking Apps In Usa

Manage your money better with our mobile banking app. ; Deposit checks. Save the trip to the bank using the mobile app. ; Pay using your digital wallet. The. Our free apps for iPhone® and Android™ phones allow you to manage your money from your smartphone. With the Clear Lake Bank & Trust App, you can: Check balances. GO2bank™ is the banking app built for everyday people. No surprise fees. No hidden fees² and no monthly fees with eligible direct deposit¹. Enroll in online banking Today. Also, utilize our mobile banking app. Discover many features such as mobile deposit and sending money via P2P. With the TD Bank app you can deposit checks, pay bills, transfer money between your accounts, send money to friends, view your account activity and more. More than 1, banking apps in the U.S. offer Zelle®, so you can use it with people you know and trust—even if they don't bank with Chase. You can also split. Best mobile banking apps · Best for variety of features: Capital One® · Best for a virtual assistant: Bank of America · Best for credit monitoring: Chase · Best for. Get the most out of our digital banking tools with interactive digital demos of our most used mobile app and online banking features. Access the easy-to-follow. Discover a world of financial apps ; Banking. Mobile banking · MoneyLion ; Wealth. Saving and investing · Acorns ; Personal Finances. Build financial health · YNAB. Manage your money better with our mobile banking app. ; Deposit checks. Save the trip to the bank using the mobile app. ; Pay using your digital wallet. The. Our free apps for iPhone® and Android™ phones allow you to manage your money from your smartphone. With the Clear Lake Bank & Trust App, you can: Check balances. GO2bank™ is the banking app built for everyday people. No surprise fees. No hidden fees² and no monthly fees with eligible direct deposit¹. Enroll in online banking Today. Also, utilize our mobile banking app. Discover many features such as mobile deposit and sending money via P2P. With the TD Bank app you can deposit checks, pay bills, transfer money between your accounts, send money to friends, view your account activity and more. More than 1, banking apps in the U.S. offer Zelle®, so you can use it with people you know and trust—even if they don't bank with Chase. You can also split. Best mobile banking apps · Best for variety of features: Capital One® · Best for a virtual assistant: Bank of America · Best for credit monitoring: Chase · Best for. Get the most out of our digital banking tools with interactive digital demos of our most used mobile app and online banking features. Access the easy-to-follow. Discover a world of financial apps ; Banking. Mobile banking · MoneyLion ; Wealth. Saving and investing · Acorns ; Personal Finances. Build financial health · YNAB.

U.S. Bank Mobile Banking 4+. Personal Finance and Invest. U.S. Bancorp · #58 in Finance. Bank anytime, anywhere. Open a new account, deposit a check, check balances, make bill payments and more – all from our mobile app on your smartphone or tablet. Orange bank & Trust's Mobile App allows users the same features as Mobile Banking, but also allows users to locate ATM & Branches and Deposit a Check through. For more than years, Simmons Bank has worked hard to help make our customers' dreams come true - like buying a home, starting a business or simply. 8 best mobile banking apps · 1. Chime · 2. CIT Bank · 3. Ally Bank · 4. Capital One · 5. Discover Bank · 6. Novo · 7. Bluevine · 8. Juno. goBank Mobile Banking. Mobile banking makes it easier than ever to manage your Bank First accounts on the go! · goBank Mobile Banking for Business. Mobile. C&F Mobile Banking · C3bank · CA Agribusiness Credit Union · Cabrillo Credit Union · Cadence Bank · Cadence Bank · CAFCU · Cal State LA FCU. Zelle® is a fast, safe, and easy way to send and receive money, right from the Santander Mobile Banking App. Check bills off your list fast. Pay your bills. Download the mobile banking app to open absolute image - Home an Visit the Porte Mobile App for a list of in-network ATMs. All other ATMs may. CitiBank · CitiBusiness Streamlined Checking. $15 monthly fee ; Axos Bank · Basic Business Checking. For businesses with simple checking needs ; Santander Bank. The Mobile Banking app 1 is packed with features to help you manage your Bank of America banking and Merrill investing accounts on the go – all in one place. Ally: Banking & Investing app · Bank of America Mobile Banking app · Capital One Mobile app · Chase Mobile app · Wells Fargo Mobile app · PNC Mobile Banking app. Transactions through mobile banking depend on the features of the mobile banking app provided and typically includes obtaining account balances and lists of. There are banks offering mobile banking services, internet-based banks, and shoploto.site · Contact Us · Privacy · Plain Writing · No Fear Act Data · Inspector. Get the Mobile Banking app ; Get it on the App Store · Or we can text a download link directly to your phone. Phone Number · Please enter a valid digit phone. HSBC apps and QR code icon; image used for downloading HSBC US Mobile Banking App For a list of compatible Apple Pay devices, see shoploto.site Below is a list of mobile devices and operating systems that are compatible USA Patriot Act · Investor Relations · Careers · Accessibility Statement. Looking for the best mobile banking app? Millions of people use Dave for cash advances, side hustles, and banking accounts with fewer fees. Make the switch! mobile money transfer app. See how the US dollar compares to other Save your receiver's details to your resend list and make repeat international money.

What Are The Risks Associated With Investment In Bonds

Bonds may not carry as much risk as stocks, but they are still exposed to certain kinds of risks. Discover what these risks in bond are. The risk that an investor faces is that the price of a bond held in a portfolio will decline if market interest rates rise. General Considerations · Credit Risk · Default Risk · High-yield Bonds · Interest Rate Risk · Reinvestment Risk · Liquidity Risk · Insurance · Underlying. Risks ; market risk for bonds · variable rate bonds ; inflation (purchasing power) risk · interest rate risk ; Default risk · Standard & Poors (S&P) ; Investment grade. Considering investing in the bond market? Explore the potential risks, including interest rate, reinvestment, call, default, and inflation risks. like all investments, bonds carry risks. one key risk to a bondholder is that the company may fail to make timely payments of interest or principal. If that. Bonds carry the risk of default, which means that the issuer may be unable or unwilling to make further income and/or principal payments. In addition, bonds. Bonds in general are considered less risky than stocks for several reasons. The average returns from bond investments have also been historically lower. Bond funds usually include higher management fees and commissions · The income on a bond fund can fluctuate, as bond funds typically invest in more than one type. Bonds may not carry as much risk as stocks, but they are still exposed to certain kinds of risks. Discover what these risks in bond are. The risk that an investor faces is that the price of a bond held in a portfolio will decline if market interest rates rise. General Considerations · Credit Risk · Default Risk · High-yield Bonds · Interest Rate Risk · Reinvestment Risk · Liquidity Risk · Insurance · Underlying. Risks ; market risk for bonds · variable rate bonds ; inflation (purchasing power) risk · interest rate risk ; Default risk · Standard & Poors (S&P) ; Investment grade. Considering investing in the bond market? Explore the potential risks, including interest rate, reinvestment, call, default, and inflation risks. like all investments, bonds carry risks. one key risk to a bondholder is that the company may fail to make timely payments of interest or principal. If that. Bonds carry the risk of default, which means that the issuer may be unable or unwilling to make further income and/or principal payments. In addition, bonds. Bonds in general are considered less risky than stocks for several reasons. The average returns from bond investments have also been historically lower. Bond funds usually include higher management fees and commissions · The income on a bond fund can fluctuate, as bond funds typically invest in more than one type.

The volatility risk is the risk that a security will lose value due to a change in volatility. This occurs when a bond is embedded with an option. As volatility. All investments involve some degree of risk. In finance, risk refers to the degree of uncertainty and/or potential financial loss inherent in an investment. To understand bond values, then, is to understand the value of its return and the costs of its risks. Bonds return two cash flows to their investors: 1) the. Risk Considerations: The primary risks associated with corporate bonds are credit risk, interest rate risk, and market risk. In addition, some corporate bonds. Risks of investing in bonds · Default risk · Interest rate risk · Inflation risk · Currency risk · We'll help you get investing. For over 1. Interest Rate Risk and Bond Prices · 2. Reinvestment Risk and Callable Bonds · 3. Inflation Risk · 4. Credit/Default Risk · 5. Rating Downgrades · 6. Liquidity. What are the specific risks involved in investing? · Price risk · Market risk · Concentration risk · Default or credit risk (bonds). Most bonds are issued by. The risks that an investor gets to face is that the price of a bond will drop in case the market interest rates rise. This risk is known as interest rate risk. When you put your hard-earned money into investment vehicles, such as stocks, bonds or mutual funds, you take on certain risks—credit risk, market risk. Building a bond portfolio with a desired risk-to-reward profile is more complex than simply buying bonds and holding them to maturity. Investment-grade bonds: Investment-grade bonds are viewed as good to excellent credit risks with a low risk of default. Top companies may enjoy having. All investments carry some degree of risk. Stocks, bonds and funds can lose value. Even conservative, insured investments such as certificates of deposit. As you can see, each type of investment has its own potential rewards and risks. Stocks offer an opportunity for higher long-term returns compared with bonds. High-risk investments may offer the chance of higher returns than other investments might produce, but they put your money at higher risk. This means that if. Vulnerability to economic cycles: High yield bonds are more vulnerable to economic changes. During economic downturns, the value of these bonds typically fall. What are the benefits and risks of bonds? · Credit risk. The issuer may fail to timely make interest or principal payments and thus default on its bonds. Bond prices fall when interest rates go up. Long-term bonds, especially, suffer from price fluctuations as interest rates rise and fall. As you can see, each. Variation in interest rate is one of the major risks. Most bonds bear fixed interest rates, and the bond value deteriorates as interest rates rise, decreasing. Stocks are much more variable (or volatile) because they depend on the performance of the company. Thus, they are much riskier than bonds. When you buy a stock. Investments in foreign securities (including ADRs) involve special risks, including foreign currency risk and the possibility of substantial volatility due to.